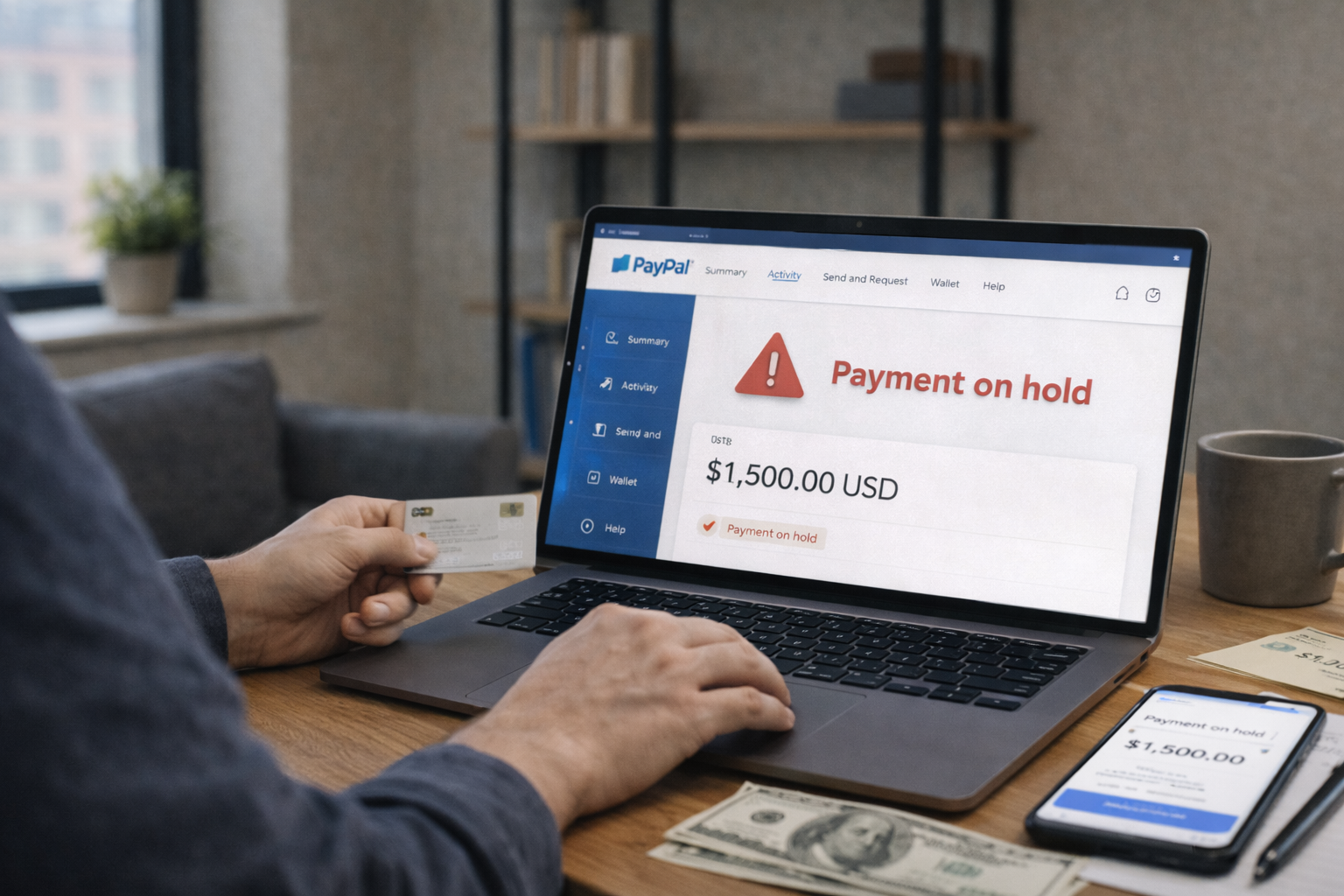

What Is a PayPal Hold?

A PayPal hold is a temporary restriction that delays access to received funds. When a payment is placed on hold, the money appears in your PayPal balance but cannot be withdrawn or used immediately.

For freelancers, PayPal holds can disrupt cash flow, delay expenses, and create uncertainty—especially when PayPal is a primary payment method.

Why PayPal Places Holds on Payments

PayPal uses automated risk and compliance systems to protect buyers and itself from fraud and chargebacks. Holds are triggered when PayPal detects patterns it considers risky.

- New or recently changed accounts

- Sudden increase in payment volume

- Large single transactions

- High chargeback or dispute risk

- Payments from unfamiliar countries

Holds are not personal—they are algorithmic and preventive.

Common Situations That Trigger PayPal Holds

New Freelancer Accounts

If your PayPal account is new or inactive for a long period, incoming payments are more likely to be held until PayPal builds a transaction history.

Inconsistent Payment Patterns

Freelancers who suddenly receive higher amounts than usual often trigger holds. Rapid growth looks suspicious to automated systems.

Client Disputes and Chargebacks

Even a single dispute can increase your risk profile and cause future payments to be held.

Digital Services and Intangible Goods

Freelance services are considered higher-risk because they cannot be physically tracked or confirmed.

How Long PayPal Holds Usually Last

Hold duration depends on account history and payment type.

- Typical holds: up to 21 days

- Verified delivery or service confirmation may reduce time

- Trusted sellers may see holds lifted earlier

PayPal rarely shortens holds automatically—you usually need to take action.

How to Release a PayPal Hold Faster

Mark the Service as Completed

If PayPal allows it, mark the transaction as a completed service. This signals that the client received what they paid for.

Ask the Client to Confirm Receipt

Client confirmation can sometimes shorten the hold period.

Provide Tracking or Proof (When Applicable)

For mixed services or deliverables, any proof of completion helps.

Best Practices to Avoid PayPal Holds

Build Account History Gradually

Increase transaction volume slowly. Avoid sudden spikes when possible.

Invoice Clearly and Professionally

Clear descriptions reduce disputes and improve trust signals.

Keep Dispute Rate Near Zero

Respond quickly to client messages and resolve issues before they escalate.

Verify Your PayPal Account Fully

Complete identity checks, link a bank account, and confirm contact details.

Withdraw Funds Regularly

Leaving large balances idle can increase risk during reviews.

When PayPal Holds Become Account Limitations

Repeated holds or unresolved issues can escalate into temporary or permanent limitations.

- Withdrawal restrictions

- Request for additional documents

- Temporary account freezes

Limitations are more serious than holds and require compliance review.

Should Freelancers Rely on PayPal?

PayPal is convenient, but it should rarely be your only payment method.

- Fast for wallet-to-wallet payments

- High FX and conversion costs

- Higher risk of holds compared to bank-based solutions

Using PayPal alongside Wise, bank transfers, or platform payouts reduces dependency risk.

PayPal vs Bank-Based Alternatives

- PayPal: fast but unpredictable for freelancers

- Wise: slower for cards, more stable for bank transfers

- Payoneer: better for marketplaces

Common Mistakes Freelancers Make

- Accepting large payments on a brand-new PayPal account

- Using PayPal for high-risk or unclear services

- Ignoring disputes or delayed responses

- Relying on PayPal as a single income channel

Conclusion

PayPal holds are common in freelance work, especially for digital services. Understanding why they happen—and how to reduce risk—helps freelancers protect cash flow and avoid unnecessary delays.

The safest approach is diversification: use PayPal when needed, but rely on bank-based and platform payouts for stability.