Wise vs Revolut for Freelancers in 2025: Which Is Better for Global Payments?

Wise vs Revolut for Freelancers in 2025: Which Is Better for Global Payments? Managing international payments has never been easier — but choosing between Wise…

Most Read

Payoneer Card Fees Explained: ATM Withdrawals, Payments, and Hidden Costs

The Payoneer prepaid Mastercard is one of the easiest ways for freelancers to access their earnings. Instead of waiting for…

Payoneer Inactivity Fee: When It Applies and How to Avoid It

Many freelancers open a Payoneer account, use it for a while, and then forget about it. What they don’t realize…

Payoneer Exchange Rate vs Market Rate: How Much You Really Lose

Most freelancers don’t notice the biggest Payoneer fee — because it doesn’t appear as a “fee”. Instead, it’s built into…

Payoneer Withdrawal Limits: Daily, Monthly, and Hidden Restrictions Explained

If you use Payoneer regularly, sooner or later you’ll run into a limit. Sometimes it’s obvious. Sometimes it’s not clearly…

Business Payouts

Business Payouts

14 ArticlesCountry Guides

1 ArticleFees & Exchange Rates

11 ArticlesFreelancer Banking

34 ArticlesPayment Platforms

40 ArticlesSWIFT Alternatives: Faster, Cheaper Global Payments

Why Look Beyond SWIFT for Global Payments? While SWIFT has long been the standard for international bank transfers, it comes with downsides: high fees, slow…

Recommended articles

Payment Orchestration Platforms: What They Are and Why Freelancers Need One

Why Freelancers Need Specialized Banking Freelancers today work with global clients, juggle multiple currencies, and rely heavily on fast, secure online transactions. Traditional banks often…

Revolut for Freelancers: Is It Worth It in 2025?

What Is Revolut and Why Freelancers Are Paying Attention in 2025 Revolut has become a household name in fintech, especially…

Freelancer Invoicing Best Practices: How to Get Paid Faster

Why Invoicing Matters More Than Ever for Freelancers In 2025, the freelancing economy is more globalized and competitive than ever…

PayPal vs Payoneer (2025): Which Payment Platform is Better for Freelancers?

PayPal vs Payoneer (2025): Which Payment Platform Is Better for Freelancers? For international freelancer payouts in 2025, PayPal and Payoneer…

How to Pay Freelancers in 2025: Best Methods and Platforms

How to Pay Freelancers in 2025: Best Methods and Platforms Freelancing continues to grow globally, and with it comes the…

Payment Platforms

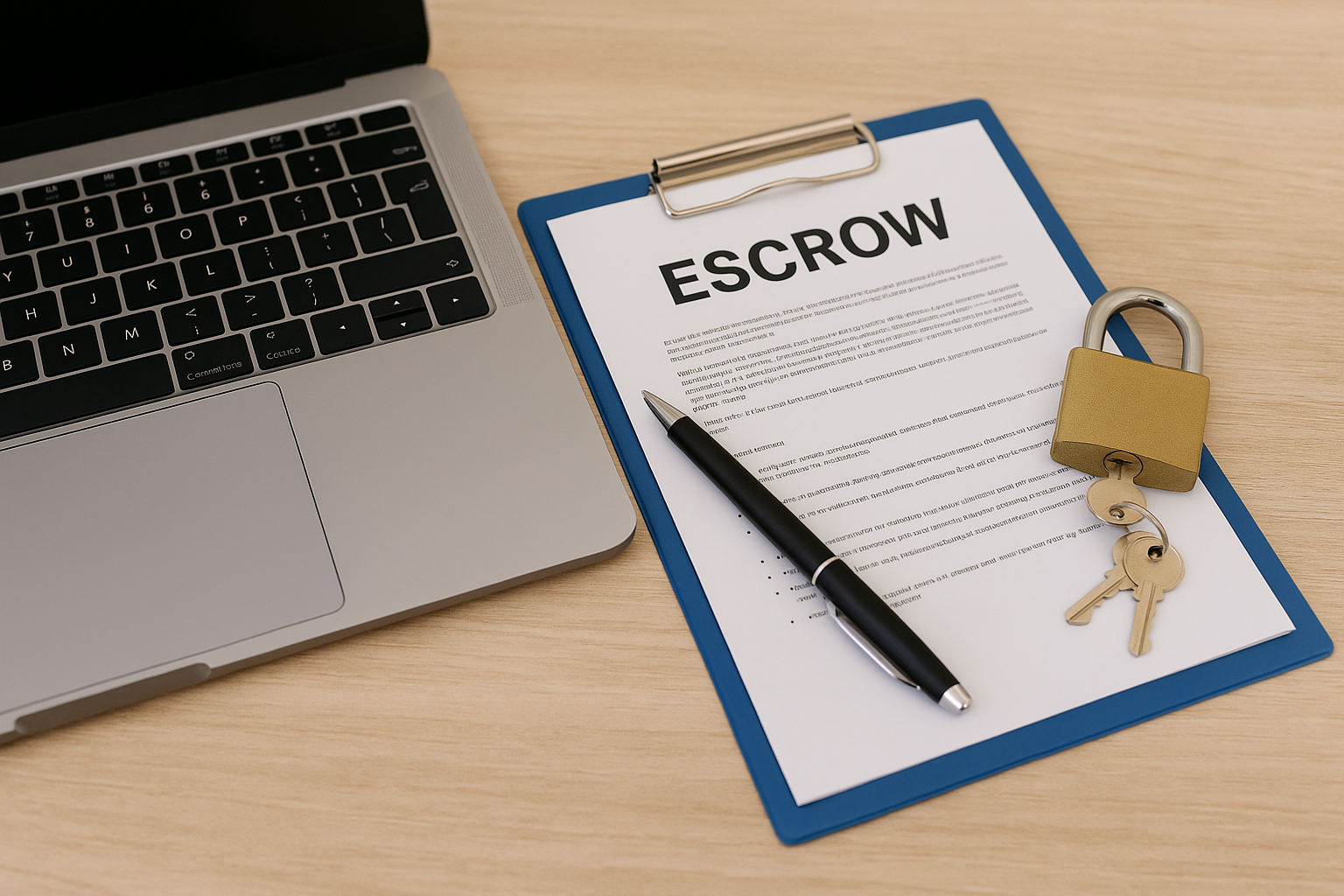

Best Escrow Payment Platforms for Freelancers in 2025

Best Escrow Payment Platforms for Freelancers in 2025 In 2025, financial safety remains a top…

How to Avoid High Conversion Fees on PayPal in 2025

Why PayPal Conversion Fees Remain a Problem for Freelancers in 2025 PayPal is still one…