Can Freelancers Use Stripe Without a Company?

Stripe is widely known as a payment processor for businesses, SaaS products, and online platforms. However, many freelancers wonder whether Stripe can be used without registering a company.

The short answer: yes, Stripe can be used by freelancers as individuals in certain countries, but there are important limitations, requirements, and risks to understand before relying on it as a primary payment method.

How Stripe Works for Freelancers

Stripe acts as a payment processor that allows clients to pay you via credit card, bank transfer, or alternative payment methods. Instead of holding funds like a wallet, Stripe processes payments and sends payouts directly to your bank account.

For freelancers, Stripe is most commonly used for:

- Direct client payments

- Invoices and recurring payments

- Subscription-based services

- International card payments

Stripe Individual vs Company Accounts

Stripe offers two main account types:

- Individual (Sole Proprietor): available in some countries, allows freelancers to operate without a registered company

- Company account: requires a registered legal entity

If Stripe supports individual accounts in your country, you can sign up using your personal details and link your personal bank account.

Country Availability for Individual Stripe Accounts

Stripe availability depends heavily on your country of residence and banking system.

Individual (non-company) accounts are commonly supported in:

- United States

- United Kingdom

- European Union (selected countries)

- Canada

- Australia

In many other regions, Stripe requires a registered company. Freelancers should always check Stripe’s official country availability before signing up.

What Information Does Stripe Require?

Even without a company, Stripe applies strict compliance checks.

- Full legal name

- Date of birth

- Residential address

- Government-issued ID

- Linked bank account

- Description of services provided

Stripe may request additional documents as your payment volume grows.

Stripe Fees for Freelancers

Stripe pricing is transparent but card-based payments are not cheap.

- Card processing: percentage + fixed fee per transaction

- International cards: higher fees

- Currency conversion: additional percentage

- Payouts: usually free to local bank accounts

For freelancers with small or mid-sized transactions, Stripe fees can be higher than bank-based platforms.

Receiving International Payments with Stripe

Stripe supports payments from clients worldwide using:

- Visa / Mastercard / AmEx

- Local payment methods (depending on region)

- Bank transfers in supported countries

This makes Stripe very convenient for clients, but the cost is often shifted to the freelancer.

Payout Speed and Cash Flow

Stripe does not offer instant access to funds by default.

- First payouts may be delayed for verification

- Standard payout cycles apply

- Delays may occur for high-risk industries

Freelancers should not rely on Stripe for urgent cash flow until the account is well-established.

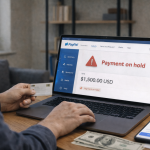

Main Risks for Freelancers Using Stripe

Stripe is powerful, but it is not risk-free:

- Account freezes during reviews

- Chargebacks from clients

- Strict acceptable use policies

- Funds may be held temporarily

Freelancers should avoid using Stripe as their only payment method.

Stripe vs PayPal, Wise, and Payoneer

- Stripe: best for card payments and subscriptions

- PayPal: fast but expensive for FX

- Wise: best for bank-based international payments

- Payoneer: best for marketplaces

Stripe works best as part of a diversified payment setup.

Best Practices for Freelancers Using Stripe

- Use Stripe for card-friendly clients

- Invoice clearly and avoid disputes

- Withdraw funds regularly

- Combine Stripe with Wise or bank transfers

Is Stripe a Good Choice for Freelancers?

Stripe can be an excellent tool for freelancers who work with international clients and need card payments or recurring billing. However, it is not the cheapest option and requires careful risk management.

For many freelancers, Stripe works best as a secondary payment method rather than a single solution.

Conclusion

Stripe allows freelancers in certain countries to receive payments without a registered company, but it comes with higher fees and stricter controls than bank-based platforms.

If used correctly and combined with other payment tools, Stripe can significantly improve client convenience and payment flexibility.