Why Freelancers Choose Crypto Payments

Crypto payments have become a practical option for freelancers working with international clients. They offer fast transfers, global accessibility, and fewer intermediaries compared to traditional banking systems.

However, receiving crypto payments also introduces new risks and legal considerations. This guide explains how freelancers can accept crypto safely, responsibly, and in a legally compliant way.

Is It Legal for Freelancers to Receive Crypto Payments?

In most countries, receiving cryptocurrency as payment for services is legal. However, legality does not mean the absence of obligations.

- Crypto is usually treated as property or a digital asset

- Income received in crypto is often taxable

- Reporting requirements vary by country

Freelancers should always check local regulations and understand how crypto income must be reported.

Best Cryptocurrencies for Freelance Payments

Not all cryptocurrencies are suitable for payments. Freelancers should prioritize stability, liquidity, and low fees.

Stablecoins (Recommended)

- USDT (Tether)

- USDC (USD Coin)

Stablecoins are pegged to fiat currencies and reduce volatility risk.

Major Cryptocurrencies

- Bitcoin (BTC)

- Ethereum (ETH)

These are widely accepted but may involve higher fees and price fluctuations.

How Freelancers Can Receive Crypto Payments

1. Personal Crypto Wallet

The most direct method is receiving payments into your own wallet.

- Full control over funds

- No intermediaries

- Higher responsibility for security

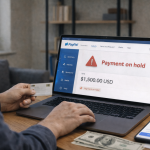

2. Crypto Exchanges

Some freelancers receive payments directly to exchanges.

- Easier conversion to fiat

- Higher compliance requirements

- Risk of temporary account restrictions

3. Payment Processors

Crypto payment processors act as intermediaries and may offer automatic conversion to fiat.

- Client-friendly experience

- Lower technical complexity

- Additional service fees

Choosing the Right Wallet

Wallet choice is critical for security.

- Hardware wallets: best for long-term storage

- Software wallets: good balance of convenience and control

- Custodial wallets: easiest but least control

Freelancers handling large payments should avoid keeping all funds in hot wallets.

How to Invoice Clients for Crypto Payments

Professional invoicing remains important even with crypto.

- Specify currency and network clearly

- Lock the exchange rate for a defined time window

- Include wallet address and memo if required

This reduces misunderstandings and disputes.

Security Best Practices

- Double-check wallet addresses before sharing

- Use separate wallets for income and storage

- Enable two-factor authentication

- Never share private keys or seed phrases

Crypto transactions are irreversible, so prevention is essential.

Tax and Accounting Considerations

Crypto income is usually taxable based on its fiat value at the time of receipt.

- Record transaction dates and values

- Track conversions to fiat

- Keep exchange rate documentation

Failing to report crypto income properly can cause legal issues later.

Common Risks Freelancers Should Understand

- Price volatility

- Wallet security breaches

- Regulatory changes

- Client mistakes with networks or addresses

Crypto vs Traditional Payment Methods

- Crypto: fast, borderless, but higher responsibility

- Bank transfers: slower, regulated, predictable

- Payment platforms: convenient but fee-heavy

Crypto works best as a complementary payment method rather than a full replacement.

Best Practices for Freelancers Using Crypto

- Accept stablecoins whenever possible

- Convert to fiat strategically

- Use crypto alongside traditional methods

- Maintain clear records for compliance

Conclusion

Receiving crypto payments as a freelancer can be safe and legal when done correctly. The key is understanding regulations, choosing the right assets, securing your wallets, and keeping accurate records.

Used responsibly, crypto offers freelancers faster payments and greater flexibility—without sacrificing compliance or security.